Blog: What does the budget mean for Maritime?

Introduction

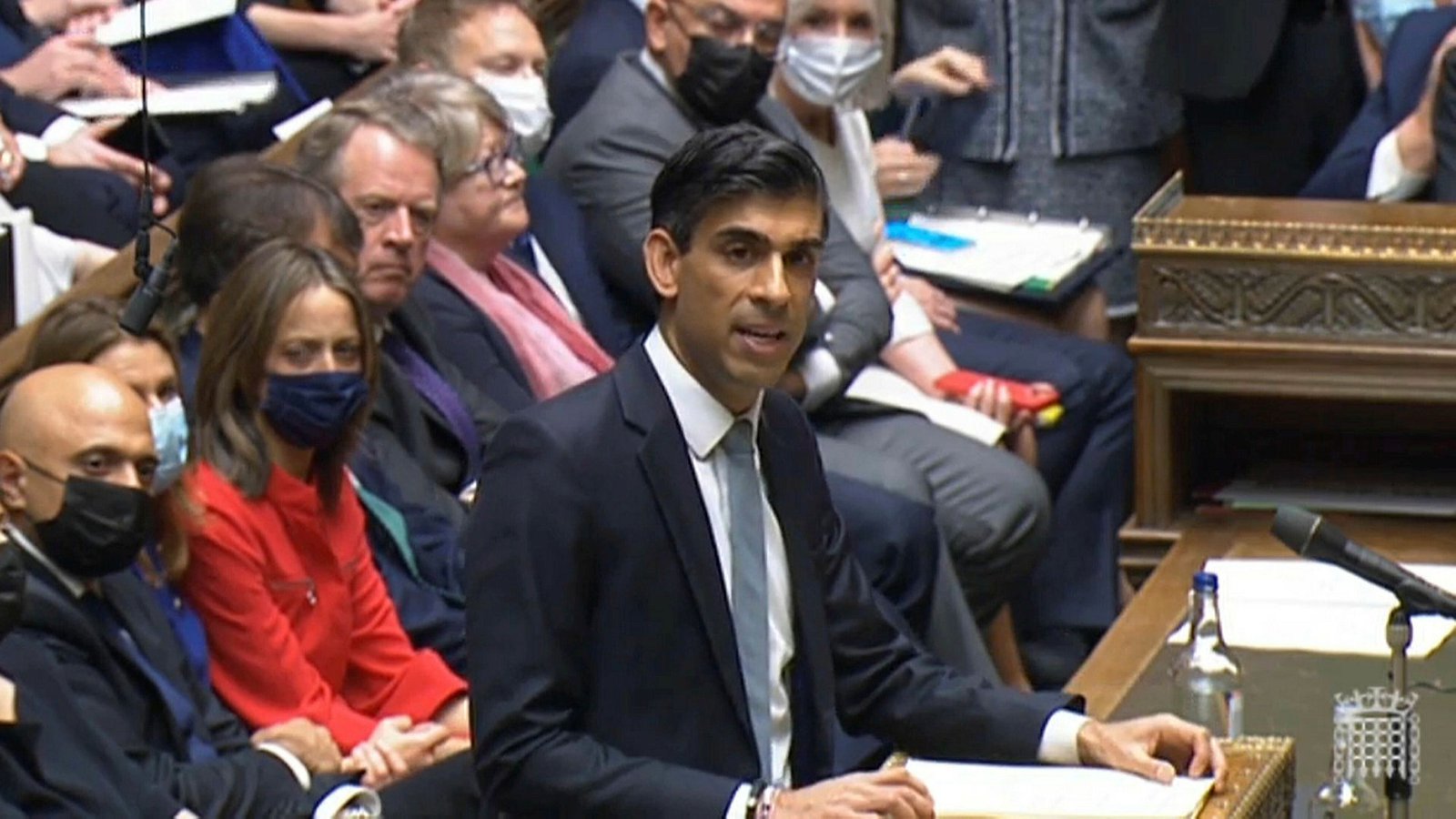

Today, 27 October 2021, the Chancellor published his Autumn

Budget and Spending Review, which sets out the Government’s spending plans

over the next three years. The title is ‘A Stronger Economy for the British

People’ and the main message is this is a Budget that heralds “an economy

fit for the new age of optimism”.

The key announcements from a Maritime UK perspective are as follows:

- The extension of the Clean Maritime Demonstration Competition (CMDC) into a multi-year programme

- Reforms to the UK’s Tonnage Tax regime

- Update on Freeports

- Shipbuilding developments

Further details

on each of these announcements is as follows:

CMDC extension

- The Budget and Spending Review announces that the CMDC will be extended into a multi-year programme, as part of £300 million for R&D programmes to help commercialise low and zero emission technologies.

- However, this £300 million includes other non-maritime elements, including trials of three zero emission HGV technologies on UK roads, and it’s not clear from the documents published how much of this investment is ring-fenced for maritime projects.

- At another point, the Budget states: “The Budget and SR provides £416 million of UK-wide R&D funding for programmes to help commercialise low and zero emission transport technologies, including trials of three zero emission HGV technologies, and a multi-year Clean Maritime Demonstration Competition.” Again, however, it’s not clear the exact amount designated specifically for the extension of the CMDC.

- Nonetheless, the extension of the CMDC, and the restatement of the Government’s commitment to a UK Shipping Office for Reducing Emissions (UK-SHORE), should be viewed as a positive result, considering this was at the core of Maritime UK’s Spending Review bid.

Reforms to the UK’s Tonnage Tax regime

- The Budget announces that: “the government will make substantive reforms to the UK’s Tonnage Tax regime for the first time since it was introduced in 2000. These reforms aim to increase the number of firms basing their headquarters in the UK, boosting the UK’s world-leading maritime services industry.”

- Announcing this in his speech, the Chancellor Rishi Sunak stated: “So I can announce today that our Tonnage Tax will – for the first time ever - reward companies for adopting the UK’s merchant shipping flag, the Red Ensign. That is entirely fitting for a country with such a proud maritime history as ours.”

- This is pitched in the Budget as an example of “Seizing the opportunities of Brexit”, stating: “The government will...remove any requirement for ships in the UK Tonnage Tax regime to fly the flag of any EU country now the UK has left the EU, and instead focus on boosting the use of the UK flag when determining which companies can participate in the regime.”

- Additionally, the Budget states: “the government will make it easier for shipping companies to participate in the Tonnage Tax regime by reducing the lock-in period from 10 years to 8 years to align more closely with shipping cycles. HMRC will be given more discretion to admit companies into the regime outside of the initial window of opportunity where there is a good reason. HMRC will also review guidance on which vessels and operations qualify for the regime to take account of developments in technology and the shipping market since the tax was introduced.”

Update on Freeports

- The Budget states that “up to £200 million” is available “to deliver eight Freeports in England, creating regions that will flourish as hubs for global trade and investment.”

- The Budget announces that the 8 Freeports announced at the previous Spring Budget will begin initial operations in November this year.

- Whilst all 8 initial Freeports announced in the Spring Budget were in England, this Budget also states that the Government “remains committed to establishing at least one Freeport in Scotland, Wales and Northern Ireland”, so further announcements on this can be expected.

- Additionally, the Budget states: “If needed, the government may, at an appropriate point, introduce further guidance for businesses claiming Freeport tax reliefs, to reflect the outcome of ongoing discussions between the UK and EU about the Northern Ireland Protocol.”

Shipbuilding

- As part of the Home Office settlement included in the Budget, it announces “an additional £74 million capital funding over the SR21 period, as part of the National Shipbuilding Strategy, to replace the Border Force fleet of five cutters and six coastal patrol vessels.”

- Additionally, the Budget restates the commitments to increased defence spending set out in the 2020 Spending Review, including a naval shipbuilding pipeline, stating: “The Budget and SR also maintains the government’s commitment to defence as set out at Spending Review 2020 (SR20), including using local skills to grow industry capability in the UK – such as directly supporting almost 19,000 jobs in industry in Scotland, Wales and Northern Ireland. This investment includes Scottish shipyards, which will benefit from the shipbuilding pipeline including the new Type 26 and Type 31 frigates”.

Overall, it is very positive that maritime features relatively extensively in the Budget and Spending Review - the commitment to extending the CMDC into a multi-year programme and to a UK Shipping Office for Reducing Emissions (UK-SHORE) were both core elements of the Maritime UK Spending Review bid, showing that it landed positively within the Treasury. The investment in Freeports, and the additional capital funding for shipbuilding as part of the Home Office settlement, should also be welcomed.

However, the documents published today do not set out in clear terms exactly how much of the announced £300 million investment for R&D programmes will be provided specifically to the extension of the CMDC, which is something that will need to be urgently clarified.